Syllabus Links

GS Paper II: Governance – Federalism/Tribal Rights

GS Paper III: Economy; Critical Minerals; Conservation related issues (Circular Economy).

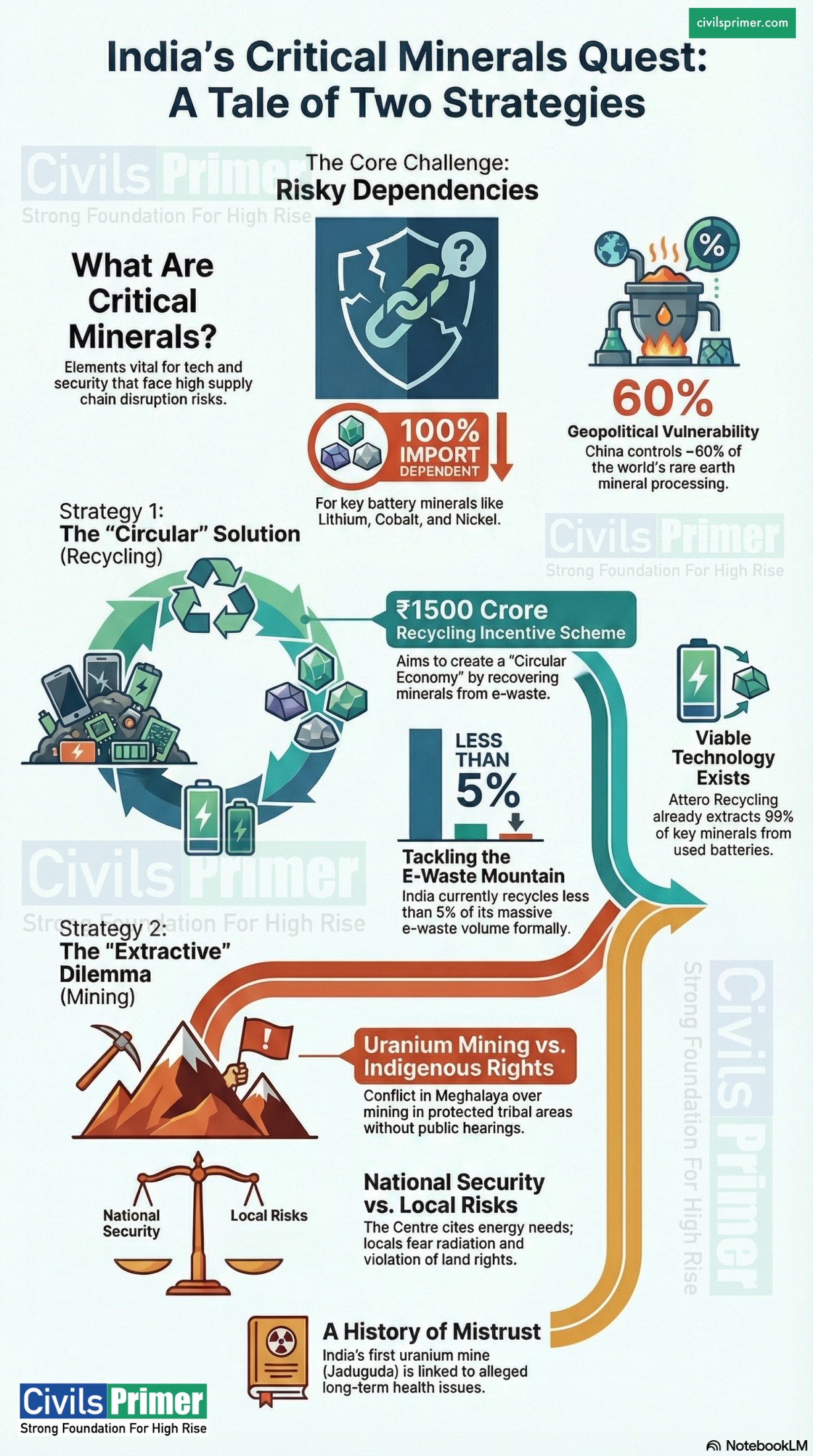

Context: The Union Cabinet recently approved the ₹1500 Crore Critical Mineral Recycling Incentive Scheme to boost domestic recovery of minerals like Lithium, Cobalt, and Nickel from e-waste. Simultaneously, the exemption of Uranium mining from mandatory public consultations in Meghalaya has triggered a constitutional debate regarding the Sixth Schedule and indigenous rights vs. National Security.

Basics: What are Critical Minerals?

Before diving into the news, it is essential to understand the core concept.

- Definition: Critical minerals are elements that are crucial for modern technologies, economies, and national security but face supply chain disruption risks.

- Why ‘Critical’?

- Economic Importance: Essential for key industries (Electronics, EVs, Renewable Energy).

- Supply Risk: High import dependence or geopolitical concentration (e.g., China controls ~60% of global rare earth processing).

- The List: In 2023, the Ministry of Mines identified 30 Critical Minerals for India, including Antimony, Beryllium, Cobalt, Copper, Gallium, Graphite, Lithium, Nickel, Rare Earth Elements (REEs), Titanium, Tungsten, etc.

Note: All Critical Minerals are not Strategic, but all Strategic Minerals are Critical.

Strategic Minerals: Specific subset required for atomic energy, defense, and space (e.g., Uranium, Titanium).

Deep Dive: The Critical Mineral Recycling Incentive Scheme

- This scheme is a component of the broader National Critical Minerals Mission.

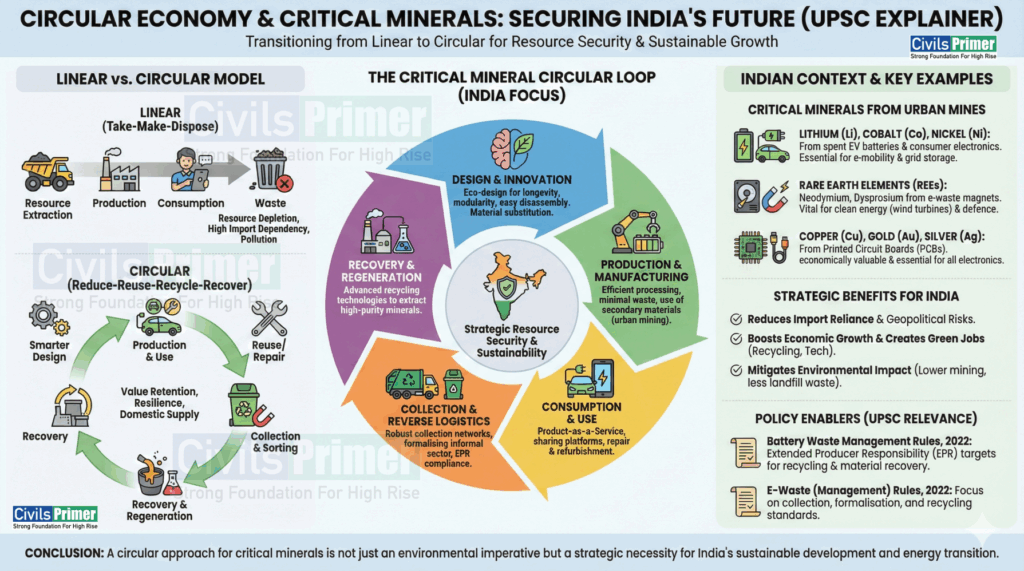

- Objective: To create a “Circular Economy” by extracting value from “Urban Mines” (e-waste, used batteries) rather than relying solely on fresh mining or imports.

- Financial Outlay: ₹1,500 Crore.

- Key Targets:

- Develop domestic recycling capacity (reducing reliance on China).

- Process spent Lithium-ion batteries (LiBs) and electronic scrap.

- Implementation Mechanism:

- Tiered Incentives: Divided into Group A (Large established recyclers) and Group B (Startups/MSMEs).

- Capex & Opex Support: Grants for setting up machinery (Capital Expenditure) and production-linked incentives (Operational Expenditure) based on the quantity of minerals recovered.

- Significance: India generates huge e-waste but recycles <5% formally. This scheme aims to formalize the sector.

The Conflict: Uranium Mining vs. Indigenous Rights (Meghalaya)

While the recycling scheme is welcomed, the push for primary mining of strategic minerals has caused friction.

- The Issue: The Centre exempted exploration/mining of Atomic Minerals (like Uranium) from mandatory “Public Hearings/Consultations” under environmental laws.

- The Flashpoint: Domiasiat and Wahkaji (Meghalaya) hold India’s largest Uranium reserves.

- The Conflict:

- Centre’s View: Uranium is vital for India’s 3-stage Nuclear Program and energy security. Public hearings delay strategic projects.

- Local View: The Khasi Hills Autonomous District Council (KHADC) and student unions oppose this, citing health risks (radiation) and violation of the Sixth Schedule (which protects tribal land rights).

- Constitutional Tussle: Does the Centre’s power over “Regulation of mines” (Union List) override the Autonomy of Tribal Councils (Sixth Schedule)?

Legal & Institutional Framework

| Instrument | Key Provision / Relevance |

| MMDR Amendment Act, 2023 | Game Changer. It removed 6 minerals (Lithium, Beryllium, Titanium, Niobium, Tantalum, Zirconium) from the “Atomic” list, allowing private sector mining and auctioning. |

| Offshore Areas Mineral (D&R) Act, 2023 | Regulates mining in maritime zones (EEZ/Continental Shelf), opening sea-bed mining for private players. |

| KABIL (Khanij Bidesh India Ltd) | A JV of three PSUs (NALCO, HCL, MECL) mandated to acquire strategic assets overseas (e.g., Lithium brine blocks in Argentina). |

| Minerals Security Partnership (MSP) | India joined this US-led alliance to secure supply chains against Chinese dominance. |

Case Studies for Value Addition

Case Study 1: The Cautionary Tale of Jaduguda (Jharkhand)

- Context: India’s first uranium mine.

- Issue: Local communities have long alleged health issues (congenital deformities, cancer) due to radiation and tailing pond mismanagement.

- Lesson: This historical mistrust fuels the current resistance in Meghalaya. Development without trust is unsustainable.

Case Study 2: Urban Mining Success (Attero Recycling)

- Context: An Indian cleantech company.

- Achievement: Extracts 99% of Lithium, Cobalt, and Nickel from used batteries.

- Lesson: Shows that the ₹1500 cr scheme has viable technological backing; India can become a “Recycling Hub” for the Global South.

Issues & Challenges towards Stragetic Mineral Security

- Extreme Import Dependence:

- Lithium, Cobalt, Nickel: 100% Import dependence (mostly from China, Congo, Australia).

- Copper: ~93% Import dependence.

- Geopolitical Vulnerability: China controls the processing node. Even if we mine Lithium, we lack refining capacity.

- Environmental Cost: Mining (especially open-cast) destroys biodiversity. Lithium extraction is water-intensive (harmful in water-stressed areas like Rajasthan/Karnataka).

- Technological Gap: We lack “beneficiation” technology (separating ore from waste) for complex minerals like Rare Earths.

- Federal Tensions: As seen in Meghalaya, bypassing local consent (Gram Sabhas) leads to project stalling and insurgency risks.

Way Forward & Recommendations

- “Urban Mining” as Policy: Enforce strict Extended Producer Responsibility (EPR) to ensure batteries return to recyclers, making the ₹1500cr scheme effective.

- Social License to Operate: For projects in Sixth Schedule areas, the government must adopt a Trust-First approach (transparent health audits, profit sharing) rather than a Force-First approach (bypassing hearings).

- Diversify Diplomacy: Leverage the Quad and Indo-Pacific Economic Framework (IPEF) to secure processing technologies, not just raw ore.

- Exploration Incentives: Fully utilize the new “Exploration License” regime to encourage private juniors to find deep-seated minerals.

Prelims: Key Facts (Don’t miss these)

- The “Critical” List: Know that Fertilizer minerals (Phosphorous, Potash) are also considered critical for India (food security), not just battery metals.

- KABIL: It is under the Ministry of Mines, not Ministry of External Affairs.

- Lithium Reserves in India: Preliminary findings in Reasi (J&K) and Mandya (Karnataka).

- Cobalt: Currently 0% domestic production.

- Global Leaders:

- Lithium Producer: Australia (Production), Chile (Reserves).

- Cobalt: DRC (Congo).

- Nickel: Indonesia.

- Processing: China dominates all.

UPSC Mains: Answer Writing Framework

Mock Mains Question: “Reducing import dependence on critical minerals is not just an economic imperative but a national security necessity. Discuss in light of the Critical Mineral Recycling Scheme and the challenges of domestic mining.” (15 Marks)

Answer Structure Guidance

Introduction:

Quote Import dependence stats (100% for Li/Co). Link to “Net Zero 2070” and “Atmanirbhar Bharat”.

Body Paragraph 1 (The Necessity):

Economic: EV target (30% by 2030).

Security: Defense electronics, Chinese leverage (weaponization of supply chains).

Body Paragraph 2 (The Solution – Domestic & Circular):

Discuss the ₹1500 cr Recycling Scheme (Urban mining as a shortcut).

Mention MMDR Amendment 2023 (Private mining).

Body Paragraph 3 (The Challenges):

Meghalaya Example: Land rights vs. Strategic needs.

Ecology: Water stress in mining zones.

Conclusion:

Conclude with the concept of “Strategic Autonomy”. We must balance Extraction (Mining) with Circularity (Recycling) and Diplomacy (KABIL).