Why is this Relevant for UPSC CSE?

GS Paper II (International Relations): Role of international institutions (WTO) in dispute redressal; Effect of policies of developed/developing countries on India (China’s aggressive trade posturing).

GS Paper III (Economy): Industrial Policy (PLI Schemes); Indigenization of Technology; Manufacturing Sector growth; Effects of Liberalization.

Interview Perspective: Balancing “Atmanirbhar Bharat” (Self-reliance) with global free trade obligations.

Context: In October 2025, China filed a formal complaint with the World Trade Organization (WTO), alleging that India’s flagship Production Linked Incentive (PLI) schemes for Electric Vehicles (EVs) and Advanced Chemistry Cell (ACC) batteries violate global trade norms. China claims these schemes unfairly favor domestic goods over imported ones (Domestic Value Addition or DVA requirements), effectively acting as prohibited subsidies.

Concept & Core Definitions: The Static Framework

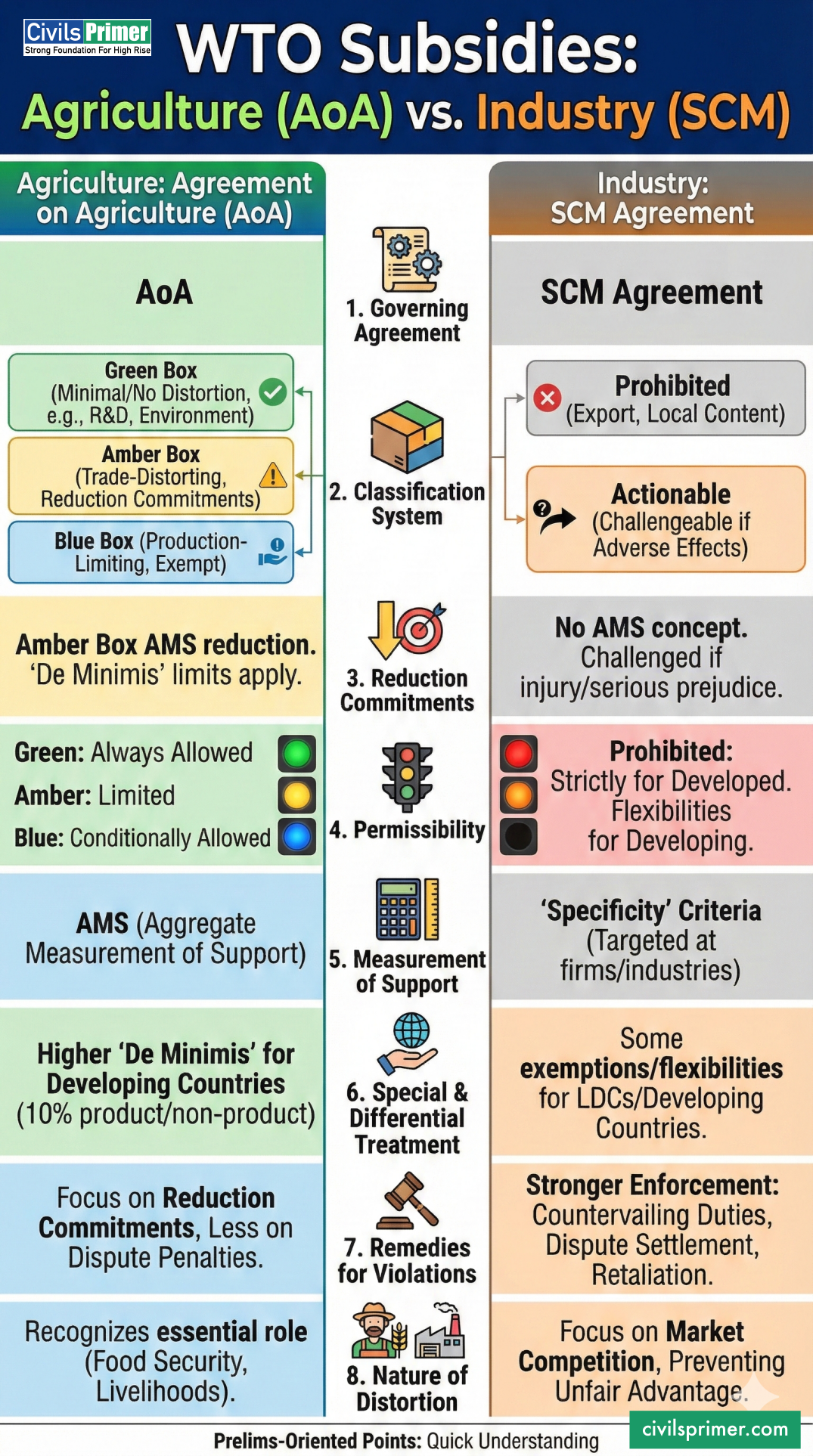

To understand the dispute, one must distinguish between Agricultural Subsidies (Green/Amber Box) and Industrial Subsidies (SCM Agreement). This dispute relates to the latter.

I. The SCM Agreement (Agreement on Subsidies and Countervailing Measures) The WTO classifies industrial subsidies into two categories (previously three, “Non-Actionable” expired in 2000):

- Prohibited Subsidies (Red Light):

- Export Subsidies: Money given only if you export (e.g., MEIS scheme, which India lost).

- Import Substitution Subsidies: Money given only if you use domestic goods instead of imported ones (Local Content Requirements). (This is China’s allegation against India).

- Actionable Subsidies (Yellow Light):

- Allowed but can be challenged if they cause “adverse effects” or “material injury” to another country’s industry.

II. TRIMs (Trade-Related Investment Measures)

- Prohibits rules that restrict trade, such as Domestic Content Requirements (DCR), which force investors to buy local inputs.

Legal / Institutional Framework

International Treaty: India is a signatory to the Marrakesh Agreement (1994), which established the WTO.

Domestic Law: India implements trade remedies through the Customs Tariff Act, 1975 (which allows Countervailing Duties on subsidized imports).

Institutional Mechanism:

- Dispute Settlement Body (DSB): The WTO’s court.

- Department of Commerce (Trade Policy Division): Represents India in these disputes.

Case Studies: Precedents & Lessons

Case Study 1: The Solar Mission Dispute (India vs. US, 2016)

- What happened: The US challenged India’s Jawaharlal Nehru National Solar Mission, which required solar power developers to use Indian-made solar cells/modules (Domestic Content Requirement).

- Verdict: India Lost. The WTO ruled that DCR violated “National Treatment” (treating foreign goods equally to domestic ones).

- Lesson: Mandating “Make in India” explicitly in policy text is a violation. Policies must be subtler (e.g., quality standards or non-discriminatory subsidies).

Case Study 2: The Sugar Subsidy Dispute (India vs. Brazil/Australia, 2021)

- What happened: Competitors alleged India’s sugar export subsidies distorted global prices.

- Verdict: India Lost. The panel ruled India’s support exceeded the 10% de minimis limit.

- Lesson: India appealed the verdict. Since the WTO Appellate Body is currently dysfunctional (due to US blocking judicial appointments), the verdict is in “void”—effectively buying India time.

Government Initiatives Under the Scanner

China has specifically targeted these three components:

- PLI for ACC Batteries (₹18,100 Cr): Incentives are linked to Domestic Value Addition (DVA)—manufacturers get more money if they use Indian raw materials.

- PLI for Auto & Auto Components (₹25,938 Cr): Requires a minimum of 50% DVA to be eligible for grants.

- EV Policy 2024: Offers lower import duties (15%) to companies like Tesla only if they commit to setting up local factories with defined localization targets.

International Landscape & Comparative Models

The world is moving away from “Free Trade” to “Managed Trade” (Protectionism).

| Country | Policy | WTO Status |

| USA | Inflation Reduction Act (IRA): Offers $7,500 tax credits for EVs only if final assembly is in North America. | Technically violates WTO rules, but the US frames it as “National Security” and “Climate Action.” |

| EU | Green Deal Industrial Plan: Relaxes state aid rules to subsidize green tech manufacturing to counter US/China dominance. | Pushes the boundary of “Actionable Subsidies.” |

| China | “Made in China 2025”: Massive state subsidies (cheap land, loans) created their EV dominance. | Often opaque, making it hard to challenge in WTO until recently (EU Anti-Subsidy probe). |

India’s Position: India argues that as a developing country, it needs “Policy Space” to industrialize. It frames PLI not as “trade distortion” but as “correcting supply chain vulnerabilities.”

Issues, Challenges & Gaps

- The “DVA” Trap: Explicitly linking subsidies to “Domestic Value Addition” is a textbook violation of Article 3.1(b) of the SCM Agreement.

- Dysfunctional Appellate Body: While this buys India time (by appealing into a void), it weakens the rules-based order that protects India from stronger nations.

- Retaliation Risks: If India persists, China could impose Countervailing Duties (CVDs) on Indian exports, hurting sectors like chemicals or textiles.

- Supply Chain Dependency: Ironically, the Indian EV industry currently needs Chinese components. A trade war could lead to China restricting exports of critical minerals (Graphite, Lithium) to India.

- Inconsistency in Arguments: India complains about Western protectionism (e.g., EU’s Carbon Tax) while defending its own protectionism (PLI).

- Legal Capacity: India often loses WTO disputes due to policy drafting errors (explicitly writing “local content” instead of using “performance standards”).

Stakeholders & Roles

- Ministry of Commerce & Industry: Defending the case at Geneva; strategizing “appeals into the void.”

- Domestic Industry (Tata Motors, M&M, Ola): Beneficiaries of PLI; they want protection from cheap Chinese EVs (like BYD).

- Foreign Manufacturers (Tesla, Hyundai): Caught in the middle; they want market access but face localization hurdles.

- MSMEs: Suppliers of auto components who benefit from the localization mandates.

Way Forward: Visionary Recommendations

- Drafting “Smart” Policies: Move from “Input-based” incentives (use local parts) to “Outcome-based” incentives (achieve carbon reduction, safety standards). This achieves the same goal without violating WTO text.

- Utilize “Peace Clause” Logic for Industry: India should lead a coalition of Global South nations to demand a “Green Peace Clause”—allowing subsidies for climate-critical tech (EVs/Solar) even if they violate trade rules.

- Leverage the “Security Exception” (GATT Article XXI): Argue that dependence on foreign batteries is a “National Security” threat, justifying domestic capacity building (similar to the US arguments on semiconductors).

- Diversify Supply Chains (China+1): Aggressively pursue the Critical Minerals Partnership with the US and Australia to reduce leverage China holds over India’s raw materials.

Answer-Writing & Question Mapping

Prelims Facts & MCQ Traps:

- SCM Agreement: Governs industrial subsidies (not agricultural).

- TRIMs: Applies only to goods, not services.

- Amber Box: Relates to Agriculture (AoA), NOT Industry. Don’t get confused!

- India’s Status: India is not exempt from the ban on export subsidies because its GNI per capita crossed $1,000 for 3 consecutive years (graduated from Annex VII status in 2017).

Mains Question (GS II/III):

“The recent WTO complaint by China against India’s PLI schemes highlights the friction between global trade rules and national industrial ambitions. Critically analyze the compatibility of ‘Atmanirbhar Bharat’ with WTO norms and suggest a way forward for India’s trade diplomacy.”

Answer Structure Highlight

- Intro: Mention the China complaint (Oct 2025) and the conflict (SCM Agreement vs PLI).

- Body: Explain why it might violate (DVA requirements = Import Substitution). Contrast with India’s need for manufacturing growth.

- Analysis: Use the “Solar Case” precedent. Mention the global shift to protectionism (US IRA).

- Conclusion: Advocate for “Smart Policy Drafting” and “Green Peace Clause.”

Current Media Comments (The Hindu, Mint – 2025): Experts argue that China’s move is less about legal correctness and more about “Lawfare”—using legal systems to slow down a competitor. China fears India replicating its own 2000s manufacturing boom. The Economic Times notes that even if India loses the panel ruling in 2-3 years, the industry would have already matured by then, making the “loss” acceptable collateral damage.